Rent Free in Sunnyvale, CA

The job position below is for a full-time Resident Apartment Manager in Sunnyvale, CA. This on-site role involves overseeing the daily operations of one or more apartment communities, including property inspections, maintenance scheduling, vendor coordination, leasing, and resident relations. Candidates should have apartment management experience, proficiency with Yardi software, strong communication skills, and a basic understanding of maintenance. The position offers a salary range of $60,000 to $70,000, a rent-free two-bedroom apartment, and benefits such as health insurance, 401(k), and paid time off. A successful background check and drug screening are required.

Sunnyvale Free Rent

RENT FREE 2 bedroom apartment included with job

Rent vs. Buy: Comparing Housing Costs Across the U.S.

Rent vs. Buy: Comparing Housing Costs Across the U.S.

Deciding whether to rent or buy a home is a critical financial decision that depends on various factors, including location, housing costs, and individual circumstances. A recent analysis by Business Insider highlights the median monthly costs of renting versus owning a home in each state, providing valuable insights for prospective homeowners and renters.

National Averages: A Snapshot of Housing Costs

- Median Rent: $1,406 per month

- Median Mortgage Payment: $1,904 per month

These national averages reflect a $498 gap, but the difference varies significantly depending on the state and market conditions.

Affordable Housing: Top States for Renters and Buyers

States with the Lowest Median Rent

- West Virginia: $850

- Mississippi: $898

- North Dakota: $916

- South Dakota: $921

- Kentucky: $929

States with the Lowest Median Mortgage Payments

- West Virginia: $1,208

- Arkansas: $1,315

- Mississippi: $1,321

- Indiana: $1,359

- Alabama: $1,372

Current Housing Decisions by State

Making the right choice between renting and buying requires evaluating individual financial goals and market conditions. Here are some state-specific examples:

- Renting offers lower upfront costs, which can be ideal for individuals in high-mobility careers or those saving for a down payment.

- Buying presents long-term benefits, including property appreciation and tax advantages, particularly in states with affordable housing markets like Indiana and Kentucky.

Should You Rent or Buy? Factors to Consider

Renting Advantages

- Flexibility: Renting is ideal for those who may need to relocate or prefer less commitment.

- Lower Initial Costs: No need for a down payment, closing costs, or maintenance expenses.

Buying Advantages

- Building Equity: Homeownership allows you to build equity over time, contributing to long-term financial growth.

- Tax Benefits: Mortgage interest and property tax deductions can lower annual tax liabilities.

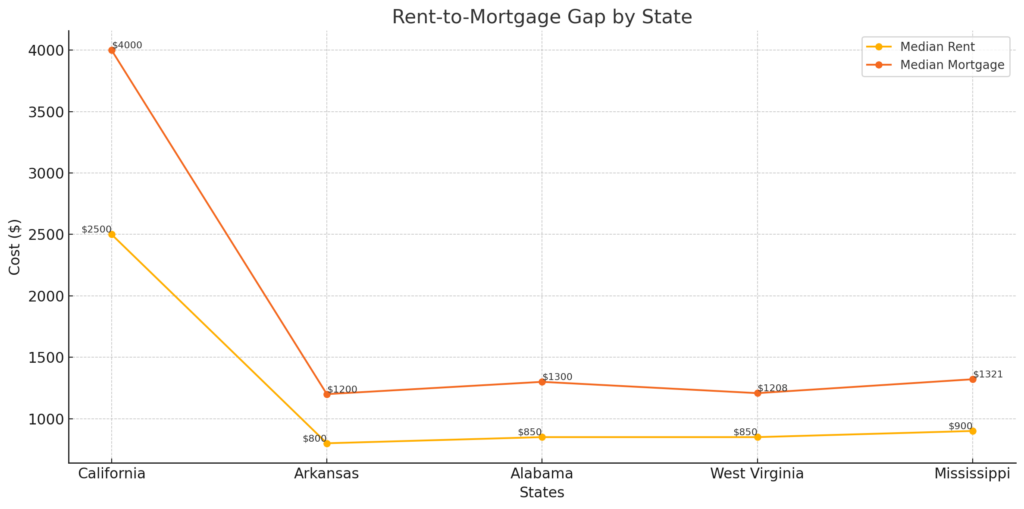

Rent-to-Mortgage Gap by State

The following data insights highlight current housing trends:

- Rent-to-Mortgage Gap: In states like California, renting may appear more affordable month-to-month, but long-term homeownership can yield higher financial benefits.

- Affordability Rankings: States like Arkansas and Alabama also show relatively low housing costs, creating opportunities for budget-conscious buyers.

These visual insights reinforce the importance of carefully evaluating rent and mortgage options before committing.

How to Get Free or Reduced Rent

- House Hacking: Rent out spare rooms or use Airbnb to offset costs.

- Work-for-Rent: Offer services like babysitting or maintenance for reduced rent.

- Property Management: Some apartment landlords exchange free housing to manage properties.

- House-Sitting: Live rent-free by caring for homes while owners are away.

- Employer Housing: Education, hospitality, or healthcare jobs may include free housing.

- Assistance Programs: Apply for Section 8 or seek rent relief from local non-profits.

- Co-Living: Share spaces in co-living communities to lower costs. These options can ease housing expenses, even in high-cost states.

Key Points

- Understanding the median housing costs in your state and evaluating personal financial situations are essential for making an informed decision. Consider your long-term goals, flexibility needs, and state-specific housing data to choose the most suitable option.

- West Virginia is the most affordable state for both renting and buying, offering the lowest median rent and mortgage payments.

- Mississippi follows closely, ranking among the top five for both rent and mortgage affordability.

- States with low housing costs often have a lower cost of living overall, making them attractive for budget-conscious individuals.